SBI Online Money Transfer Ke Liye Beneficiary Add Kaise kare

State Bank of India ne apne customer ke liye banking system ko bahut hi easy kar diya hai. Jaise new account ke liye online apply karna ho, online internet banking activate karna ho, online money transfer karna ho, Jab SBI net banking se ham kisi other bank account par money transfer karte hai to uske liye sabse pahle beneficiary add karna parta hai.

Jabse online banking service start hua hai to logo ko bhi bahut asani ho gaya hai. SBI ke branch me jakar jab ham kisi other account pe paise bhejna hota hai to 2-2 ghanta line laga kar khra rahna parta hai.

Or kibhi link fail hai to kabhi strap nahi aaya hai, kabhi khuch hai kabhi kuch hai, isi tarah ka bahana bank branch me chalta hai.

Ab hame money transfer karne ke liye parishani outhane ki jarurat nahi hai, ye sub kam ab ham online kar sakte hai. Chahe hame SBI ka new account opening karna ho, (SBI Me New Account Online Apply Kaise Kare uski jankari yaha hai),

Aur chahe hame internet banking start karna ho, (SBI me internet baking srevice online activate kaise kare uski jankari yaha hai). Pahle hame ye sab kam karne ke liye branch ka chakkar lagana parta tha.

- Upgrade Access Level in SBI Net Banking Problem Solve kaise kare

- No Account Mapped For This Username SBi Problem Solve kaise kare

SBI Me Beneficiary Add Kyu karte hai ?

Kisi bhi Bank account me money transfer karne ke liye sabse pahle hame us bank account ko verify karna padta hai, Yani account ko apne online banking se jodna parta hai, jisse hum Beneficiary add karna kahte hai.

Jab tak aap ke net banking me Beneficiary add nahi hoga tab tak aap usko online Paise/ money send nahi kar sakte hai.

Sabhi banks me online money transfer karne ke liye hame sabse pahle jis account ko paisa send karna hai wo account hamare Internet banking ke beneficiary list me add hona jaroori hota hai. Third party Account ko Beneficiary list me add karne ke baad hi aap us account par money online send kar sakte hai.

SBI Me Beneficiary add Kaise kare ?

State Bank of India me beneficiary add kana bahut hi aasan hai. bas aapke pass jiss account ko apne internet banking se jodna hai. Us other aadmi ka aapke pass ye sab hona chahye.

- Bank account Number.

- Account holder Name.

- Branch Name ya IFSC Code:

State bank of India me aap 3 type se other parson bank account jodne ke liye beneficiary add kar sakte hai.

- Within SBI intra bank beneficiary:

- Other SBI inter bank Beneficiary:

- IMPS Beneficiary:

To dosto ab main aapko in teno ke bare me bata ounga ke sbi me money transfer ke liye beneficiary add kaise kar sakte hai. bas aapko uske liye niche diye gaye step ko follow kare.

Step 1: Online SBI ?

SBI internet baking me aapko Sabse pahle login karna hai. Login karne ke liye aapko https://onlinesbi.com par visit kare or apna username and password dal kar online sbi account me login kare.

Agar aapne abhi tak SBI Internet Banking activate nahi kiya nahi hai to aapko tension lene ki koi jarurat nahi hai. Bas aap apne ATM/Debit card aur account registered mobile number ko use kar ke aasani se Net banking online activate kar sakte hai.

Also Read:

- SBI me Net Banking online Activate kaise kare

- Sbi me first time user net banking activate kare

- SBI me online found transfer kaise karte hai

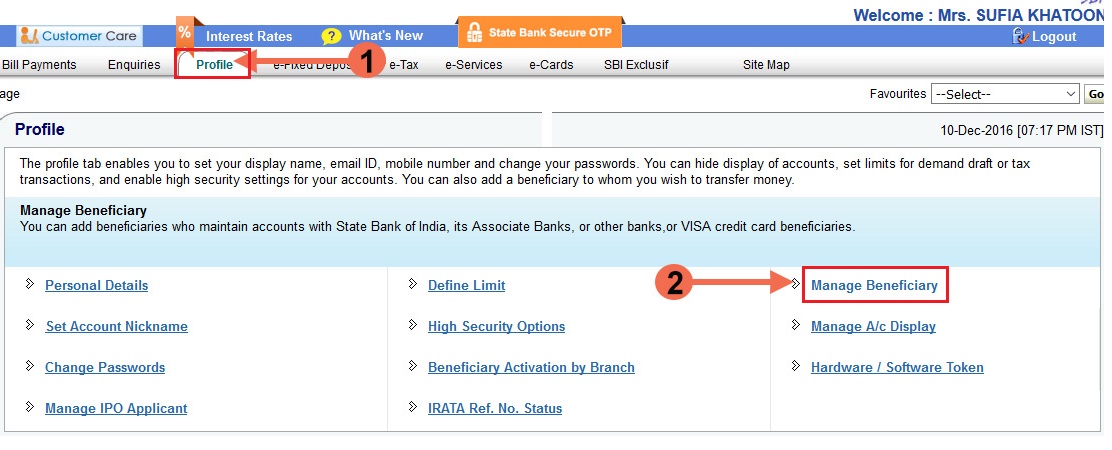

Step 2: SBI Profile

Online SBI me login karne ke bad beneficiary add karne ke liye sab se pahle aapko Profile tab par click karna hai. Ye aapke samne top page par honga “Profile” par click karne ke bad aapko “Manage beneficiary” button par kelec karna hai.

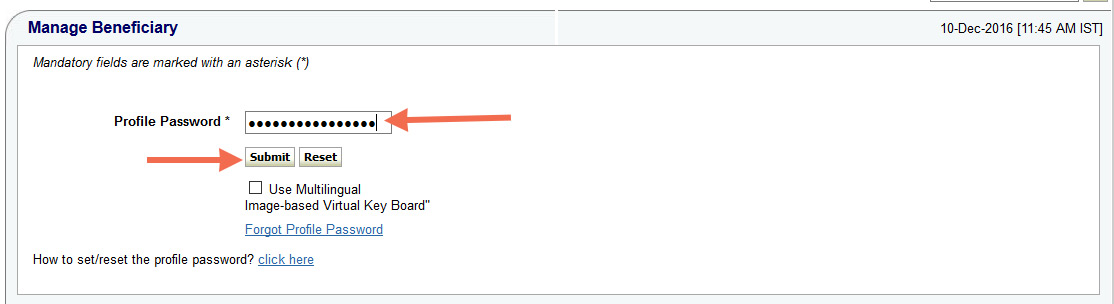

Step 2: profile password ?

Ab aapke samne jo next screen aayega usme apna Profile password enter karna hai. “Profile password” enter karke “Submit” button par click kare.

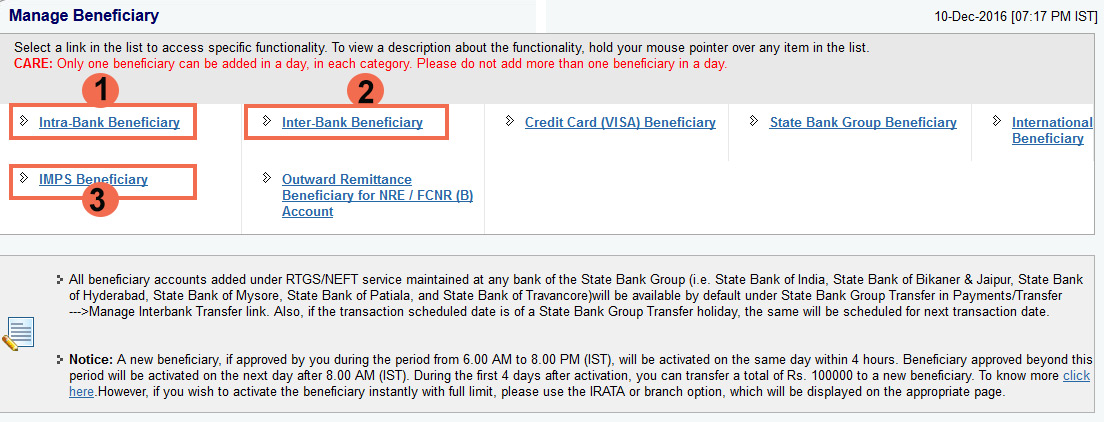

Step 3: Manage beneficiary ?

Ab aap online sbi manage beneficiary section me pahunch gaye hai yaha par aap alag-alag Account ke liye different type Beneficiary add kar sakte hai.

- Intra-bank beneficiary: Agar aapko SBI to SBI money transfer karna hai to is option par click kar.

- Inter-Bank beneficiary: Agar aapko SBI se other bank account me money send karna hai to is option par click kare.

- IMPS beneficiary: IMPS (immediate payment service) fast money transfer karne ke liye aap IMPS beneficiary account par click kare.

SBI Fund Transfer karne ke liye hame 3 type beneficiary add karne ki jarurat padti hai. to ham sabse pahle BSI to SBI bank account ko add karenge.

Note: State bank of India me Account ko jorne ke liye sabhi ka next posses same hai isle mai aapko yaha in 3 type ka pahle first page ke bare me bataounga uske bad akhir me account approved karne ke bare me bata ounga.

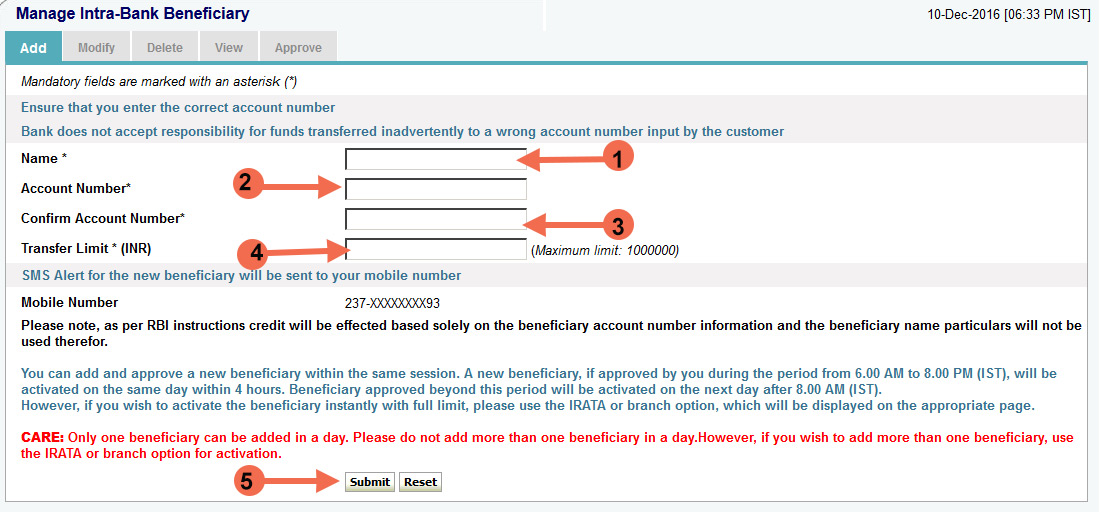

1. Add Intra-Bank Beneficiary (SBI To SBI)

Intra-bank ka matlab hota hai SBI TO SBI account. Agar aapke pass kisi other person ke SBI bank account me paisa transfer karna hai to sabse pahle aapko us addmi ka bank account add karna hoga. Uske liye aap “Intra-bank beneficiary” button par click kare.

- Name: Ya par Account holder ka naam dale.

- Account Number : Yaha par bank khata number dale.

- Confirm Account Number: ya par dobara same khata number dale.

- Transfer Limit : Yaha par paise ka limit dale 100000 dale. Jab aap uske account pe money bhejenge to yaha par jetna likha hai usse jada nahi bhej sakte hai ek bar me.

- Submit : Sab sahi dalne ke bad Submit button par click kare.

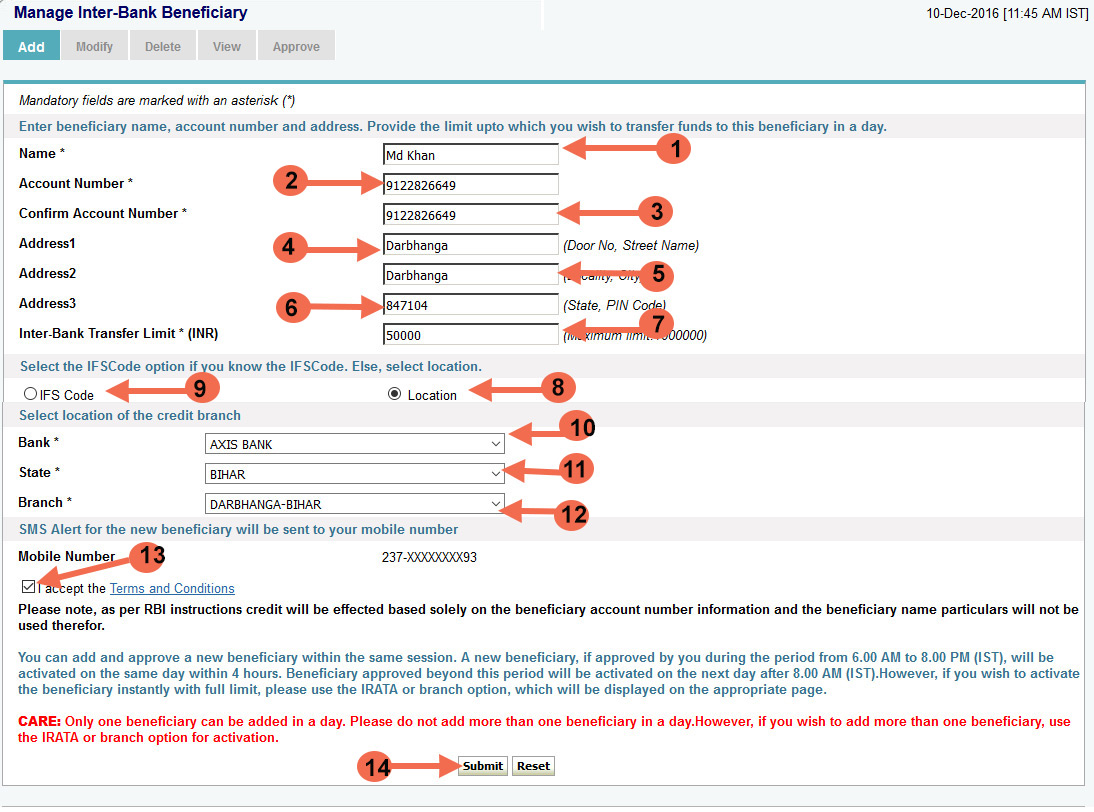

2. Add inter-Bank Beneficiary (SBI To Other Bank)

Ab aap ko SBI to other bank account ko apne online internet banking se jodne ke liye “Inter-bank beneficiary” button par click karna hai. Yad rahe ke jis kisi other bank ka beneficiary add kana hai to uske liye aapke pass IFSC Code ya pranch name hona chahiye. Bank ka ifsc code kaise pata kare uske liye (is link par click kare).

Ya aapko other bank account parson ka pura details dalna hai. Jaise bank Name, account number, account name, etc….

- Name * Isme account holder ka naam dale.

- Account Number * isme khata number dale.

- Confirm Account Number * isme dobara same khata number dale.

- Address 1 (Door No, Street Name) isme branch ka Village dale.

- Address 2 (Locality, City) isme kis city me branch hai vodale.

- Address 3 (State, PIN Code) isme post pin code dale.

- Inter-Bank Transfer Limit * (Maximum limit:1000000) dale.

- Location : Agar aapko IFSC code malum nahi hai to Cocation select √ mark kare.

- IFS Code * Agar aap ko ifsc code pata hai to isse √ mark karke code dale. (Search ifsc code).

- Bank* Isme other parson ka bank name select kare. Ye option Location select karne ke bad ayega.

- State* Isme State chune ke kisme hai jaise UP, Bhihar WB, Delhi etc..

- Branch* Isme city chune ke kis shahar me bank hai.

- I accept the Terms and Conditions* isko √ mark kare kare.

- Submit * Sab sahi dalne ke bad last me submit button par click kare.

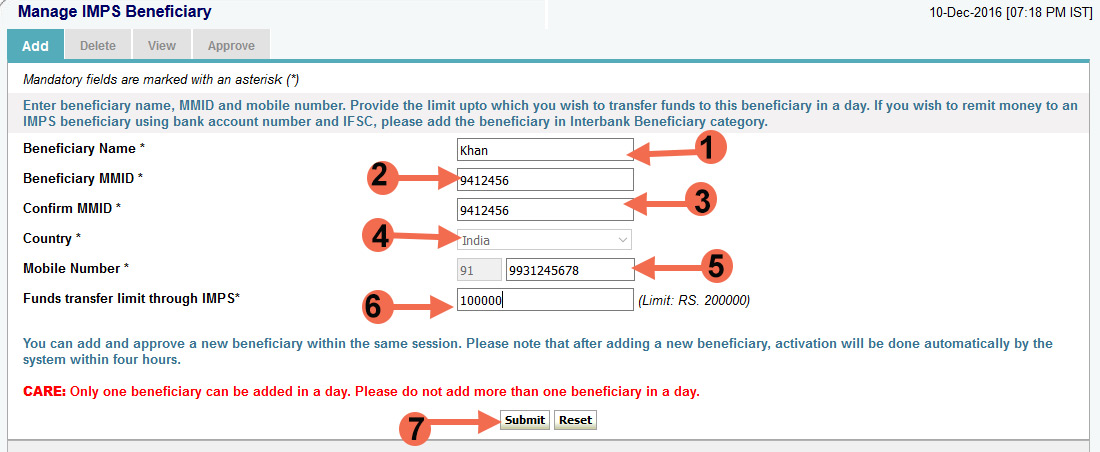

3. IMPS beneficiary Quick transfer ?

IMPS – fast money transfer service hai, kuch seconds me aapka paisa kisi bhi bank account me transfer kiya ja sakta hai. IMPS fund transfer aap 2 tarah se kar sakte hai.

- 1 Jisko money send karna hai uska bank IFSC code use karke.

- 2 Or jisko paisa bhejna hai us samne wale person ka MMID and Mobile number hona chahiye.

Agar aapke paas other person ka MMID and mobile number aapke pass hai to aap IMPS beneficiary add kar sakte hai.

Or aapke paas uska MMID and mobile number nahi hai to aap IMPS add nahi kar sakte hai, aisi condition me aap IFSC code se IMPS fund transfer kar sakte hai. Par usme 1 day me 5000 se jada money transfer nahi kar sakte.

IMPS Add karne ke liye “IMPS Beneficiary” button par click kare.

- Beneficiary name: isme account holder ka naam dalye.

- Beneficiary MMID: Isme other parson ka MMID Code daliye

- Confirm: MMID : isme sam vahi daliye.

- Country : Isme India dale.

- Mobile Number : isme uska mobile number dale.

- Funds transfer limit through IMPS: isme 100000 dale.

- Submit : uske bad last e submit button par click kare.

Dosto maine aapko teeno step bata diya hai ab aapko account approved karna hai uska tarika bhi same hai usme aapko koi changing nahi milega. jis tarah SBI to SBI ko approve karenge same ussi tarah IPMS ko bhi approve kae lenge.

- UC Union Kya Hai – Uc Union Par Account Kaise Banaye

- Axis Bank Net Banking Se Online Money Transfer Kaise Kare

SBI Me Online Money Transfer Ke Liye Beneficiary Account ko Approve Kaise Kare ?

Bank aacount ko apptove karna bahut asan hai bas aapke hath me bank register mobile number hona chahiye. kuy ke aapke bobile pe one time password ayega usme OTP code hoga usko yaha dal kar account verify karna hai.

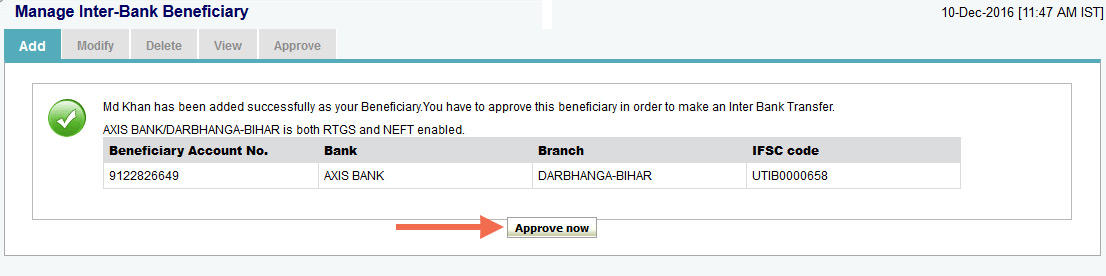

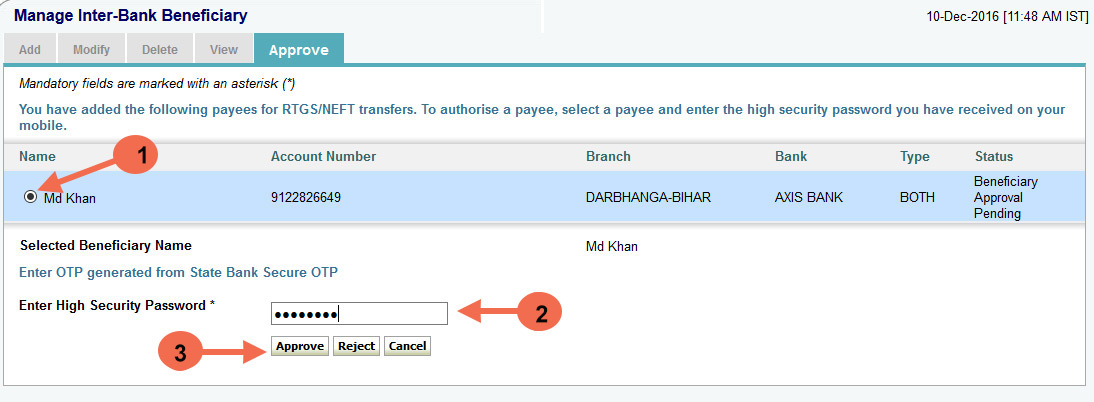

Step 4: Account Beneficiary Approve

Jab aap submit button par click karenge to next screen me Approve ka option ayega yaha aapko “Approve now” button par click karna hai.

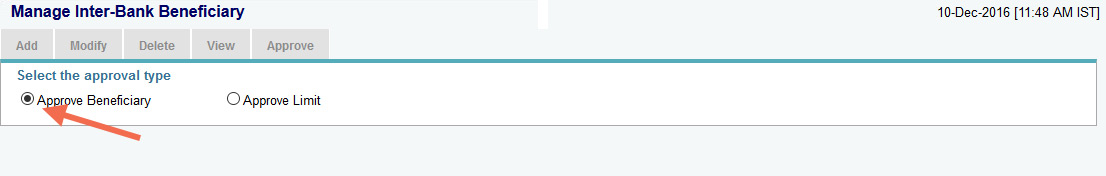

Step 5: Approve Beneficiary

Ab aapke pass 2 option ayega Approve limit and approve beneficiary par click karna hai.

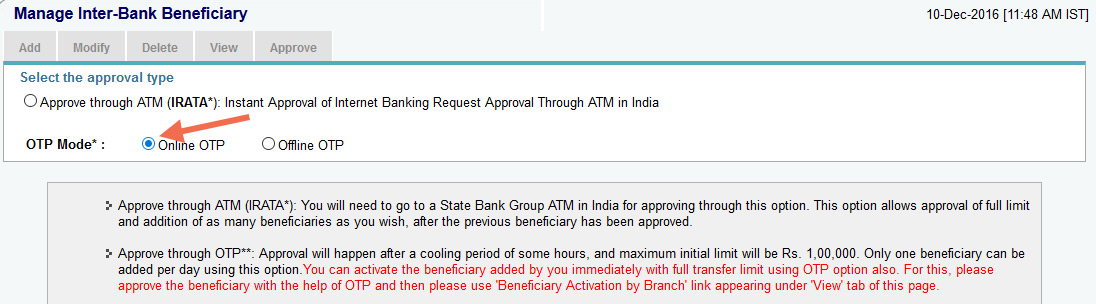

Step 6: Approval type

Ab aapse pucha jayega ke account Approve karne ke liye aap ATM use karna chahte hai ya OTP Mode. aapko Approve through OTP select karna hai. Uske bad aapke registered mobile number par high security code aayega jo aapko next screen me enter karna hai.

Step 6: Enter High security password

Ab aapke samne jo screen ayega usme aapko OTP password dalna hai. aapke registered mobile number par high security code message receive hua hoga.

- Sab se palhe name ko tick mark kare.

- Enter High security password: me moblie par jo OTP Password aya hai usko yaha dale.

- Last Approve button par click kar de.

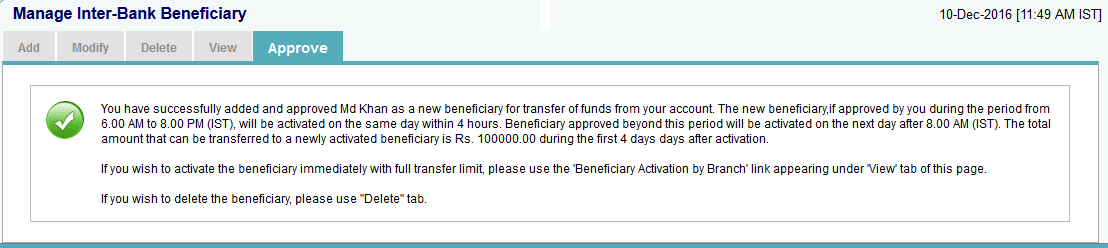

Ab aapka account approved hogaya hai. You have successfully added and approved ka message ajayega bas aapka beneficiary activate hone me 24 hours bhi lag sakta hai. uske bad hi aap fund transfer kar sakte hai.

To dosto aapne ketne aasani se online sbi me account ko jod liya hai. bus kuch is tarah se aap SBI me online money transfer karne ke liye Beneficiary account add kar sakte hai. Or kisi bhi other bank account holder ko paisa online bhej sakte hai.

- Aadhaar Card Ko SBI Bank Account Se Link Kaise Kare

- SBI Bank Account Me PAN Card Online Link/Register Kaise Kare

Aap apne SBI account se money transfer karne ke liye Internet banking, Mobile app, State bank anywhere and SBI freedom ko mobile me install kar ke use kar sakte hai.

Or One time password (OTP) ke liye bhi SB Secure OTP app mobile me install kar sakte hai jisse aapko one time paasword mobile message ki jagah app pe ayega.

Also Read…

Really very nice article yr. bakai apne bhut mehnat ki hai article likhne me so bhut bhut dhanyabad apka

thank u sir for sharing this great information. This article is very helpful for me